Better-than-expected U.S. economic data and a shift in market positioning helped the dollar extend its gains versus other major currencies yesterday. U.S. durable goods orders increased by 1.3% in December, exceeding market forecasts for a 1.0% rise. Furthermore, weekly initial U.S. jobless claims came in at 283,000, below expectations for 305,000 reading.

The CNB left interest rates unchanged at 2% yesterday, but revealed that board members discussed possible lowering of interest rates. Vice-Governor Ludek Niedermayer then warned that the bank could again consider, or even deliver, a rate cut next month if the crown remains strong or firms further. Consequently, the crown weakened against the euro.

| FX RATES | |

| USD/CZK | 23.305/335 |

| USD/GBP | 1.7788/90 |

| EUR/CHF | 1.5493/99 |

| EUR/CZK | 28.440/460 |

| USD/YEN | 116.24/28 |

| EUR/GBP | 0.6858/61 |

| EUR/USD | 1.2198/3 |

| EUR/YEN | 141.81/88 |

| STOCK MARKETS | ||

| NIKKEI | 16460.68 | +569.66 |

| EUROSTOXX 50 | 3641.42 | +63.42 |

| FTSE 100 | 5722.6 | +18.2 |

| DAX 30 | 5548.91 | +121.82 |

| S&P 500 | 1273.83 | +9.15 |

| NASDAQ | 2283.00 | +22.35 |

| PX 50 | 1513.8 | -15.4 |

| GOLD | 557.50/+558.25 | - |

| DEPOSIT RATES | ||||

| CZK | USD | EUR | YEN | |

| ON | 1.91-2.01 | 4.42-4.45 | 2.30-2.33 | --- |

| 3M | 2.15-2.25 | 4.62-4.65 | 2.50-2.53 | --- |

| 6M | 2.30-2.40 | 4.74-4.77 | 2.64-2.67 | 0.03-0.08 |

Elektromobilistům nastávají krušné časy. Elektromobily v mrazu ztrácejí až 40 % dojezdu a nabíjí se velmi pomalu

Elektromobilistům nastávají krušné časy. Elektromobily v mrazu ztrácejí až 40 % dojezdu a nabíjí se velmi pomalu

Test Seat Ateca: Zlaté staré časy aneb jistota v rozbouřených vodách a za dobrou cenu

Test Seat Ateca: Zlaté staré časy aneb jistota v rozbouřených vodách a za dobrou cenu

Šidit, svařovat totálky, kitovat a stáčet tachometry aneb v kůži polského autobazaru. Vyzkoušet pochybné praktiky si teď může každý

Šidit, svařovat totálky, kitovat a stáčet tachometry aneb v kůži polského autobazaru. Vyzkoušet pochybné praktiky si teď může každý

Řidiči, držte si klobouky. V nadcházejícím roce se změní řada věcí. Víme, které to budou

Řidiči, držte si klobouky. V nadcházejícím roce se změní řada věcí. Víme, které to budou

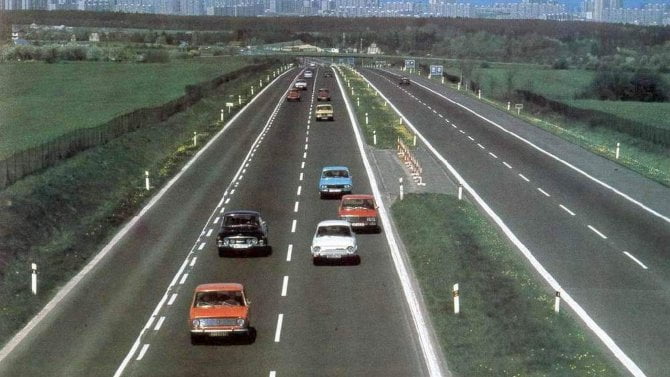

Až budete stát v koloně na D1, můžete slavit. Dálniční propojení Prahy a Bratislavy se otevřelo před 45 lety

Až budete stát v koloně na D1, můžete slavit. Dálniční propojení Prahy a Bratislavy se otevřelo před 45 lety