The dollar initially surged against the euro on Friday after a report showed the U.S. GDP rose only 1.1% in Q4, lagging well behind analysts' expectations for a 2.8% expansion and being strongly down from a 4.1% growth in Q3. But a higher-than-expected inflation component of the GDP report gave the dollar a boost, making analysts believe the Federal Reserve's interest rate rises will continue beyond this month. The core PCE index, a measure of inflation closely watched by the Fed, rose 2.2%, above forecasts' for a 1.6% increase. Stronger-than-expected data on home sales published later combined with technical factors also supported the dollar in late trading.

Tracking other currencies in the central European region, the crown turned firmer against the euro on Friday. Ignoring threats from the CNB it could cut interest rates at its next monetary policy meeting late February, the Czech unit came back withing sight of its historic peak.

| FX RATES | |

| USD/CZK | 23.340/370 |

| USD/GBP | 1.7664/69 |

| EUR/CHF | 1.5522/30 |

| EUR/CZK | 28.310/33 |

| USD/YEN | 117.37/41 |

| EUR/GBP | 0.6850/54 |

| EUR/USD | 1.2107/12 |

| EUR/YEN | 142.12/21 |

| STOCK MARKETS | ||

| NIKKEI | 16551.23 | +90.55 |

| EUROSTOXX 50 | 3685.48 | +44.06 |

| FTSE 100 | 5786.8 | +64.2 |

| DAX 30 | 5647.42 | +98.51 |

| S&P 500 | 1283.72 | +9.89 |

| NASDAQ | 2304.23 | +21.23 |

| PX 50 | 1517.6 | +3.8 |

| GOLD | 561.30/+562.20 | - |

| DEPOSIT RATES | ||||

| CZK | USD | EUR | YEN | |

| ON | 1.91-2.01 | 4.48-4.51 | 2.31-2.34 | --- |

| 3M | 2.15-2.25 | 4.62-4.65 | 2.50-2.53 | --- |

| 6M | 2.30-2.40 | 4.76-4.79 | 2.65-2.68 | 0.03-0.08 |

Elektromobilistům nastávají krušné časy. Elektromobily v mrazu ztrácejí až 40 % dojezdu a nabíjí se velmi pomalu

Elektromobilistům nastávají krušné časy. Elektromobily v mrazu ztrácejí až 40 % dojezdu a nabíjí se velmi pomalu

Test Seat Ateca: Zlaté staré časy aneb jistota v rozbouřených vodách a za dobrou cenu

Test Seat Ateca: Zlaté staré časy aneb jistota v rozbouřených vodách a za dobrou cenu

Šidit, svařovat totálky, kitovat a stáčet tachometry aneb v kůži polského autobazaru. Vyzkoušet pochybné praktiky si teď může každý

Šidit, svařovat totálky, kitovat a stáčet tachometry aneb v kůži polského autobazaru. Vyzkoušet pochybné praktiky si teď může každý

Řidiči, držte si klobouky. V nadcházejícím roce se změní řada věcí. Víme, které to budou

Řidiči, držte si klobouky. V nadcházejícím roce se změní řada věcí. Víme, které to budou

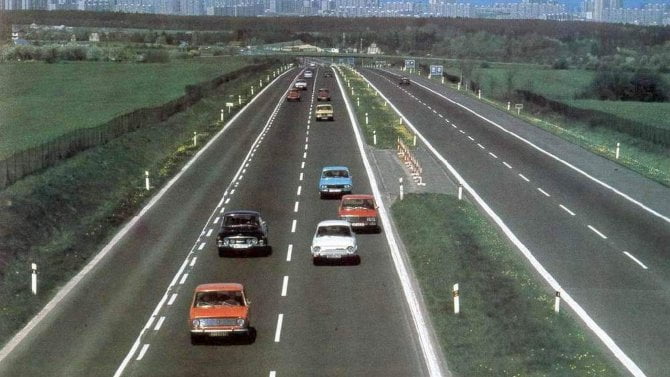

Až budete stát v koloně na D1, můžete slavit. Dálniční propojení Prahy a Bratislavy se otevřelo před 45 lety

Až budete stát v koloně na D1, můžete slavit. Dálniční propojení Prahy a Bratislavy se otevřelo před 45 lety